The first question that I had, after coming up with a long list of seemingly underpriced and high risk stocks in 2008, was how to execute these ideas through an online trading account. It was a question that I think I only found the right answer for me a short while ago, although as with every subjective question, the answer varies upon the person. For me, starting with a small amount of capital (but an amount that I could afford to take heavy losses on), having the potential to generate large profits was particularly important. The three main types of accounts that are widely available are:

Standard Online Trading Account

Standard Online Trading Account

- Standard online trading account (e.g. Comsec/Westpac) with no leveraging – these are usually long only services, and I would recommend trading online only with all brokers as the cost of placing a trade over the phone (or seeking professional advice) would make most trades unprofitable. Researching and developing your own ideas means that you learn far quicker, and greatly increases your value as a trader. $1000 capital means $1000 invested, and since I stayed away from small cap stocks, there was little to be made or lost. Unlike some CFD accounts, there is often a proportion of free research included, and whilst you are often the last market participant to receive it, it can still be a very useful tool (hint: you can sign up for a Comsec account and have access to the research without trading!)

Margin Loan Online Trading Account

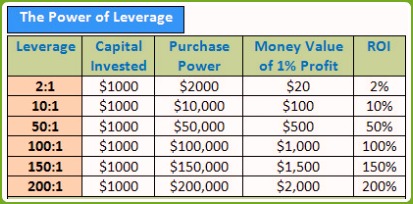

- Online trading accounts with a margin loan (again, Comsec/Westpac) – these are available as an addition to most standard online trading accounts, but the broker contributes up to 75% of the investment amount, allowing your $1000 to buy $4000 worth of shares. This is known as the leverage ratio, or LVR. The catch is that you are charged interest (approx 10% at present) on the amount that they lend you ($3000, making the effective rate on the trade 25% lower). Paying this high rate is unnecessary, as the below option provides cheaper access to increasing your investment size. The advantage is you are still buying ordinary shares at this point, and so are entitled to a say in the company’s running and its dividends (neither of which were important to me).

|

| Demonstration of leverage |

CFD Online Trading Account

- Online trading accounts with CFDs (contracts for difference, e.g. IG Markets) – again offered through most online brokers, the difference being that you can trade forex, global stocks etc, as supposed to just shares/options/warrants, and the interest charged on the amount lent to you is far lower (around 4% at present). The leverage ratio is much higher (90% on stocks, 99.5% on forex) meaning that to have the same $4000 investment as with the margin loan example, only $400 of your money is needed if the leverage ratio is 90%. These accounts don’t entitle you to dividends (you essentially trade replicas of the shares, not the actual ones), but do allow you to take short positions, which can greatly improve your performance if used wisely.

The key reasons I’d recommend a CFD trading account is that, if you focus on risk management, you have the potential to make meaningful returns through trading a wider range of assets and short selling. This gives you more trading opportunities, rather than making trades because there are no other options at the time.

Most importantly, remember to compare all the online trading accounts that you you can find, and never rush into anything too quickly. This link gives a good overview of how leverage can work, and above all, how it can work against you. Once you understand how to use risk management techniques however, it can be used to great effect, and when you are ready will allow you to start generating higher profits.

- In the pipeline – an introduction on risk management on a leveraged or standard trading account

- Bullish on: Gold stocks (underpriced relative to gold’s value, price suggests gold's is at $1000 not $1600, will correct quickly when market rallies)

- Bearish on: Telstra (TLS – approaching broker price targets, could fall over the next 6 months as TLS is sold to fund riskier assets), US 10yr T-Notes (yields supported by good US data in the short term, 1-2 week short trade or be prepared to ride out volatility and hold short throughout 2012 if markets rise)

No comments:

Post a Comment